What Is a Reason One Discounts Future Cash

Make sure to advertise your sale clearly emphasizing the discount rates you will be offering and the specific. Future cash flows the terminal value and the discount rate should be reasonably estimated to conduct a DCF analysis.

How To Use Discounted Cash Flow Time Value Of Money Concepts

What is a reason one discounts future cash flows as part of the absolute valuation process a future profits are uncertain bdeflation makes future cash flows worthless c investors prefer future payments to payments today Consider the formula GDP CIG X-M.

. The discounted future earnings method uses forecasts for the earnings of a firm and the firms estimated. Discounted future earnings is a method of valuation used to estimate a firms worth. One reason for this is that the interest payments.

What is a reason one discounts future cash flows as part of the absolute valuation process. We arrive at that number by assuming a discount rate of 10. The rate we use to discount a companys future cash flows back to the present is known as the companys required return or cost of capital.

Of a business as part of a Discounted Cash Flow DCF Discounted Cash Flow DCF Formula This article breaks down the DCF formula into. Future profits are certain. If all 204000 spark plugs are purchased at the start of the year a discount of 2 off the9 price will be given.

What is a reason one discounts future cash flows as part of the absolute valuation process. A fishery exceeding fishing quotas. For each cash flow event the present value is less than the corresponding future value except for cash flow events occurring today in which case PV FV.

Future profits are uncertain Explain. D Future profits are certain. This approach can be used to derive the value of an investment.

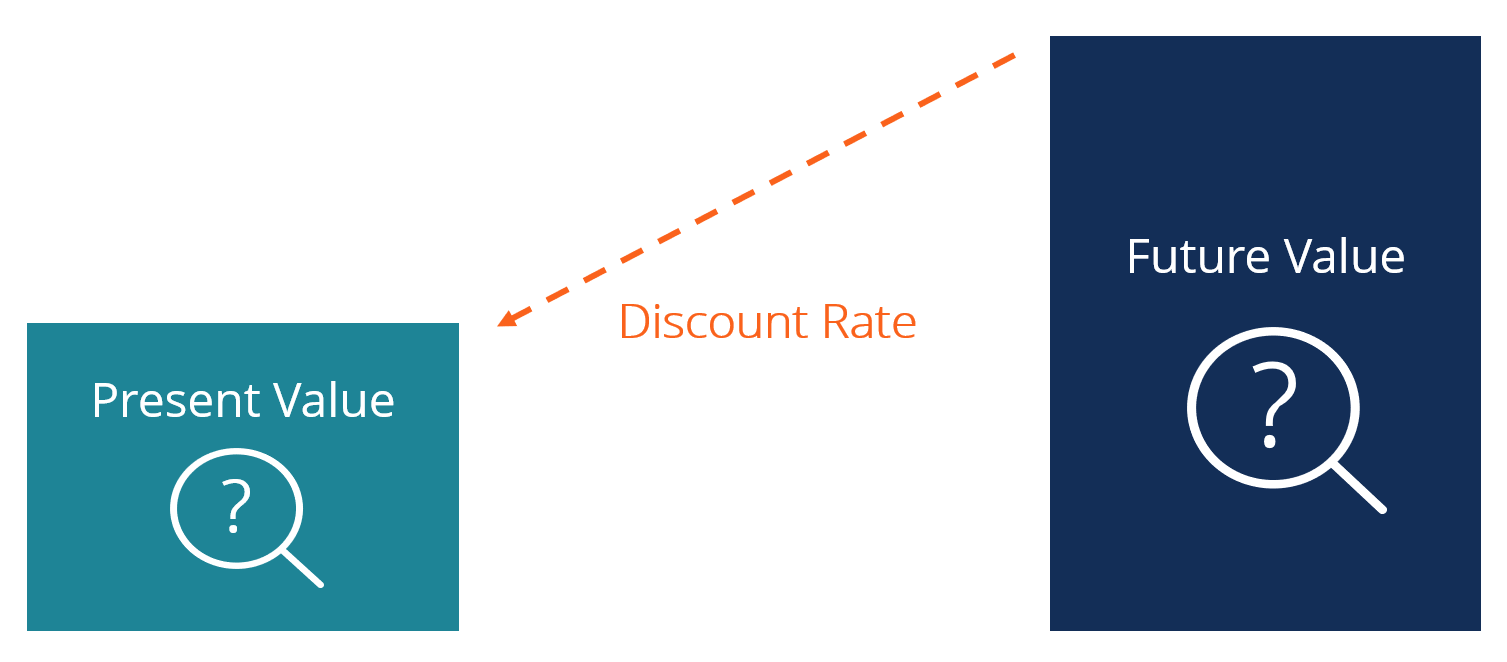

Discounted cash flow DCF evaluates investment by discounting the estimated future cash flows. What is a reason one discounts future cash flows as part of the absolute valuation process. Discount rate i is the rate that money is discounted over the time the rate that time addsdrops value to the money per time period.

The total of all of the cash flow present values for the cash flow series across a timespan. DCF analysis attempts to figure out the value of an investment. It is the interest rate that brings future values into the present when considering the time value of money.

Increased Traffic Offering discounts for a limited time will attract customers into your store and most likely draw them into buying these items right away. A cash discount is a reduction in the price paid for a product or service if you pay with cash immediately or within a certain specified period of. A discount rate is used to calculate the Net Present Value NPV Net Present Value NPV Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present.

Discount rate represents the rate of return on similar investments with the same level of risk. C Investors prefer cash flows today to cash flows in the future. Under the DCF method one applies a discount rate to each periodic cash flow that is.

What is a reason one discounts future cash flows as part of the absolute valuation process. The company might do a share split which will diminish the value of ones stake b. What is a reason one discounts future cash flows as part of the absolute valuation process.

Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. B Deflation makes future cash flows worthless. D Future profits are certain.

Best Trim estimates that 17000 spark plugs will be required each month. Jul 14 2021 0457 PM. To find out if the project is a good investment opportunity you would discount the future cash flows to find the present value of the money.

A project or investment is profitable if its DCF is higher than the initial cost. Enterprise value market cap cash debt. Future profits are uncertain.

C Investors prefer cash flows today to cash flows in the future. The further into the future before a cash flow event occurs the more discounting lowers the present value below its future value. Best Trim can invest its cash at 10 per year.

A The company might do a share split which will diminish the value of ones stake. A supplier quotes a price of 9 per spark plug. Here are the many reasons why small business owners should not be afraid of offering discounts.

Up to 256 cash back What is the reason one discounts future cash flows as part of the absolute valuation process. What is a reason one discounts future cash flows as part of the absolute valuation process a future profits are uncertain bdeflation makes future cash flows worthless c investors prefer future payments to payments today Widget Co has a market capitalization of 100 million. A The company might do a share split which will diminish the value of ones stake B Deflation makes future cash flows worthless C Investors prefer cash flows today to cash flows in the future D Future profits are certain.

What is a reason one discounts future cash flows as part of the absolute valuation process a future profits are uncertain bdeflation makes future cash flows worthless c investors prefer future payments to payments today. How is enterprise value calculated. Equit investors expect at least the US.

B Deflation makes future cash flows worthless. Discounted cash flow DCF is a technique that determines the present value of future cash flows. Governments bond yield ideally a lot more to compensate them for the uncertainty of the future profitability of the company in question.

In the example investment opportunity above the buying power of the 6000 generated in each year decreases as time goes on. It does a 10-for-1 stock split. What is a reason one discounts future cash flows as part of the absolute valuation process.

In addition future discount cash flows should be involved in the entire valuation process. The time value of money is the reason why you discount cash flows. It then does a 1-for-16 reverse stock split.

The supplier also offers a special discount option. Because we know that future profits are unpredictable and uncertain so here the investor should have the best cash flows for today to make future cash flows. If we assume that Dinosaurs Unlimited has a cash flow of 1 million now its discounted cash flow after a year would be 909000.

A The company might do a share split which will diminish the value of ones stake. Deflation makes future cash flows worthless c. Investors prefer cash flows today to cash flows in the future d.

In the years that follow cash flow is increasing by 5.

10 Types Of Social Posts That Generate Follower Engagement Socialmedia Face Marketing Strategy Social Media Social Media Measurement Social Media Infographic

Discount Rate Definition Types And Examples Issues

Immutable Blockchain Gaming Company Raises Extra 15mil For Gods Unchained Blockchain Blockchain Game Emerging Technology

Comments

Post a Comment